31 Dec 2025

Thinking: When does Less become More? The value of subtraction.

When we look to improve things, research has shown that the common bias among people is to add more, rather than looking to remove things. Research by Adams, Klotz, et al. in the scientific journal Nature (Footnote 1), which has also been made more accessible in Leidy Klotz’s book “Subtract” (Note 2) both demonstrate that when faced with a problem, most people, including experts, will tend to add improvements, rather than looking to take things away from what is already there.

We usually assume the question to be what more can be done to make something better, not what could be removed with the best results?

This simple idea has some profound implications for our modern world. Whether it be the expansion of legislation or regulations, or just the ever-lengthening list of responsibilities we take on. Many of us find that each year of our lives adds more things to keep an eye on, more plates to juggle. And for those with families, it can certainly feel as though the same thing happens to our children too.

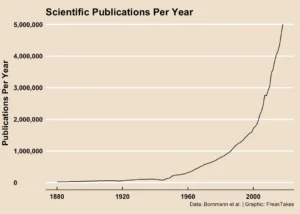

Clearly the world around us has become bigger and more complex in many ways. The fields of human knowledge and the amount of information available has exploded. The annual volume of scientific publications, just as one example, has expanded enormously since the 19th century. Even the total content in a core school science syllabus that has been added in the last hundred years should give us pause for thought. Consider that the double-helix structure of DNA was only confirmed in 1953, and how far our understanding of cellular biology and genetics, even at school level, has come since then.

However, a lot of what we add may just be “clutter”. For example, when you watch a sports event or a live music festival, and dozens or even hundreds of people are using phone cameras to live-broadcast clips from the event, the total data output is substantial, but in most cases, none of it is particularly innovative.

It can be useful once in a while to look at our own lives, and consider the question: what could I subtract to improve things?

In finance too, the temptation to keep tinkering, and adding things on is always there. There is an entire industry of ‘funds-of-funds’ – where individual investment funds are aggregated together in a multitude of slightly different re-combinations, in order to widen the apparent variety of investments available. Very often, these different funds cover almost the same ground and offer limited diversification benefits.

We have all felt at times that the UK tax system, for example, as well as many of the regulations we’re now subject to, have added layer upon layer, like fresh leaves on top of hundreds of years of decomposing muck. This is hardly a UK-specific problem – many countries are bogged down by bureaucracy and a proliferation of unintended consequences. Because we live in an increasingly complex and inter-dependent world, getting out a blank sheet of paper to start again from scratch is not an easy task, and may be fraught with pitfalls.

When it comes to personal finance, it can also be easy to let things proliferate. I’ve even met people who have chosen to work with two or three different financial advisers, in the name of diversity, or just because they picked them up as they went along and never quite grasped the nettle thereafter. The loser in the end is the customer if they have to repeat everything multiple times, and engage in overlapping meetings each year. The bigger risk however, is that adding more and more makes it easier for you to forget what is where, or who you told about what.

In personal finance, less really can be more. Focusing on a smaller range of clearly set out goals, using just a few tax wrappers and avoiding the exotic end of the investment universe, can not only give you the necessary diversification, but also prevent major errors when too many different things are being attempted simultaneously. One example would be consolidating pension pots or other investments, where there is a clear rationale for doing so. This can bring considerable peace of mind that you have a coherent investment approach, and reduces the number of pieces of paper arriving or different account log-ins needed to keep track of it all.

How might you simplify your life? How have you simplified your financial affairs?

If you would like to discuss your financial plans, including how you can stop things from becoming overly complicated – book a free initial chat together.

https://calendly.com/duncan-bw-hoebridgewealth/30min

FOOTNOTES

2 – https://behavioralscientist.org/subtract-why-getting-to-less-can-mean-thinking-more/

None of the above is financial or investment advice and you should speak to me or someone else professionally qualified to give you advice specifically tailored to your circumstances.

Production

Production