31 Aug 2025

Investment: What’s the value of a steady income stream in retirement?

It is not a glib point to say that one of the best strategies for retirement is to secure a final salary pension (also known as a Defined Benefit Pension) – either by having one yourself, or being partnered with someone who does – like a civil servant, local government official, or someone else lucky enough to still have this sort of pension.

As we noted recently (July Article) there is some uncertainty about the future viability of such pensions, which have largely been withdrawn by private employers. However, almost everyone working in the UK does contribute to the state pension which may be the closest thing they have to a dependable retirement income stream.

The current state pension in 2025-26 for those with the full 35 qualifying years of National Insurance contributions is £11,973 per year. How much difference does an income like this make to someone’s retirement plans? Let’s have a look.

CASE STUDY: Ms. Pancake

Ms. Pancake is currently age 66, and planning to retire in 2026. She has saved £500,000 into her personal pension, which is invested in a Balanced Portfolio. She has no other assets to provide her with income. In her retirement, Ms. Pancake will require £35,000 per year of spending money, in today’s terms – which therefore will rise over time with inflation.

With no other income, the median scenario is that Ms. Pancake is likely to run out of money by age 88, or in just over 21 years after her retirement.

However, in a more pessimistic scenario, during a period of time similar to those over the last century when investment returns have been less good, the forecast is that Ms. Pancake will run out of money by age 84, around 17 years after retiring.

Neither of these forecasts is particularly good news, given that the Office of National Statistics expects a female currently 66 years old to live until an average of age 88, with 25% of 66 year olds expected to reach age 94 and 10% of them age 98. Effectively, this means there’s a 25% chance that Ms. Pancake could outlive her money by 6 years in a median scenario, or even 10 years in a pessimistic scenario.

By contrast, if Ms. Pancake is eligible for the full state pension, her entire forecast is significantly improved. Even in a pessimistic scenario, the addition of a state pension income means that her pension is likely to last until age 99 in at least 68% of the future scenarios in the model.

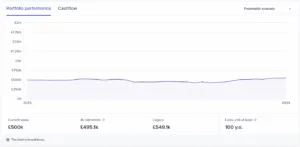

However, 68% likelihood of success is cutting things awfully fine (as can be seen by how little is left as a legacy at age 99). A good financial planner might also look at how to tweak the overall investment strategy for Ms. Pancake to further improve the chances of a successful retirement. With a clearer understanding of what might be needed when, the longevity of her investments may be bolstered further. Below, we can see that with a spread of different risk exposure for different parts of Ms. Pancake’s investments, even in a pessimistic scenario Ms. Pancake’s plan is now likely to be sustainable to age 99 in 91% of the historical scenarios, with a forecast legacy remaining of over £549k, which offers a very comfortable buffer. For example to cover additional later-life costs such as care services.

This case study underlines a few important points about retirement:

- Cashflow planning can help to make the road ahead far more clear

- A regular income such as the state pension can make a major difference to the total assets required to fund your retirement

- Good investment strategy and the support of a financial adviser can also make a substantial difference to your likely overall outcomes in retirement

If you want to discuss your retirement planning, pensions and investments or wider financial planning – book a free initial chat with me

https://calendly.com/duncan-bw-hoebridgewealth/30min

NOTE: A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The value of your investment can go down as well as up. Past performance is not a reliable indicator of future results. None of the above is financial or investment advice and you should speak to me or someone else professionally qualified to give you advice specifically tailored to your circumstances.

Production

Production