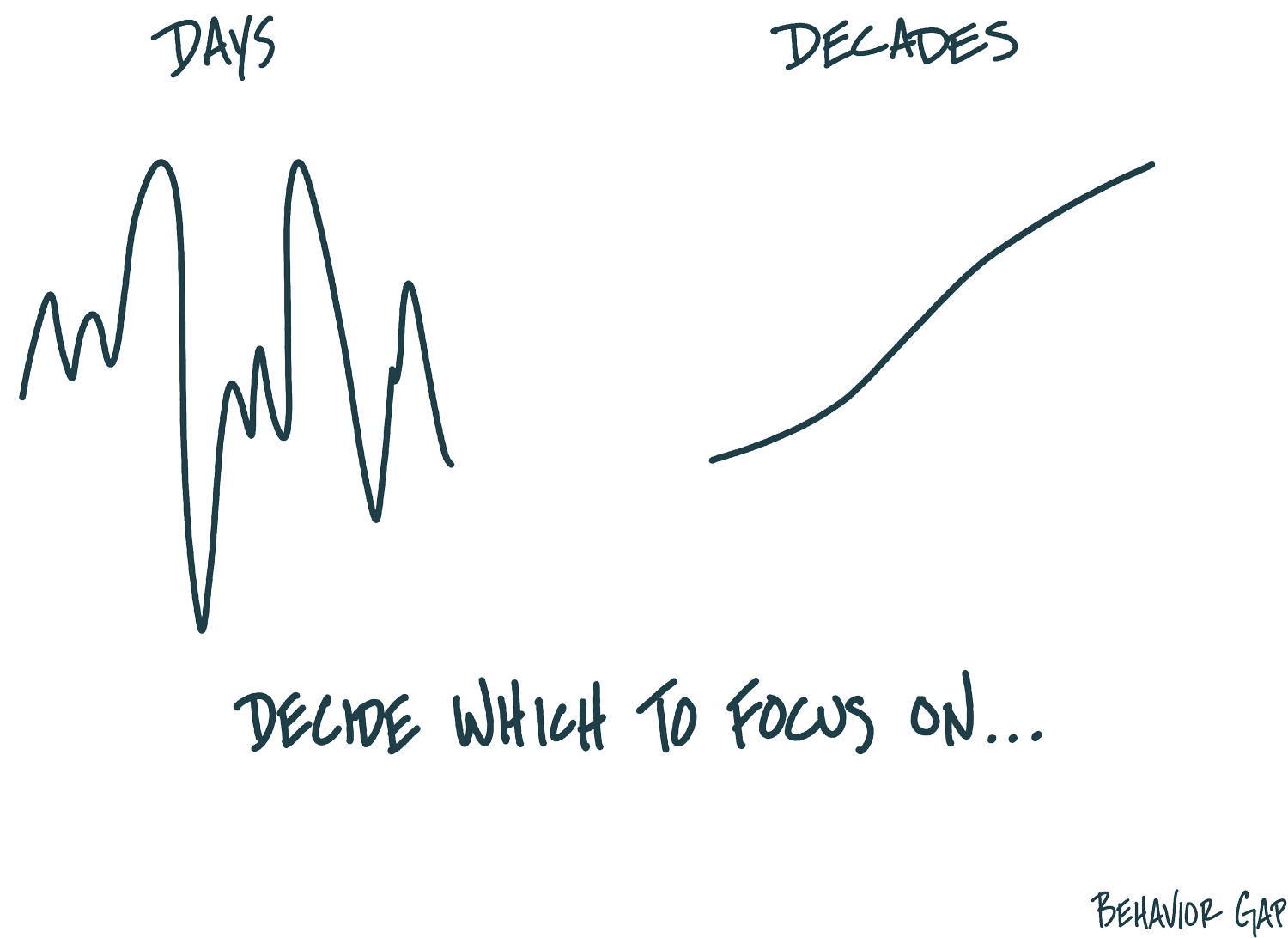

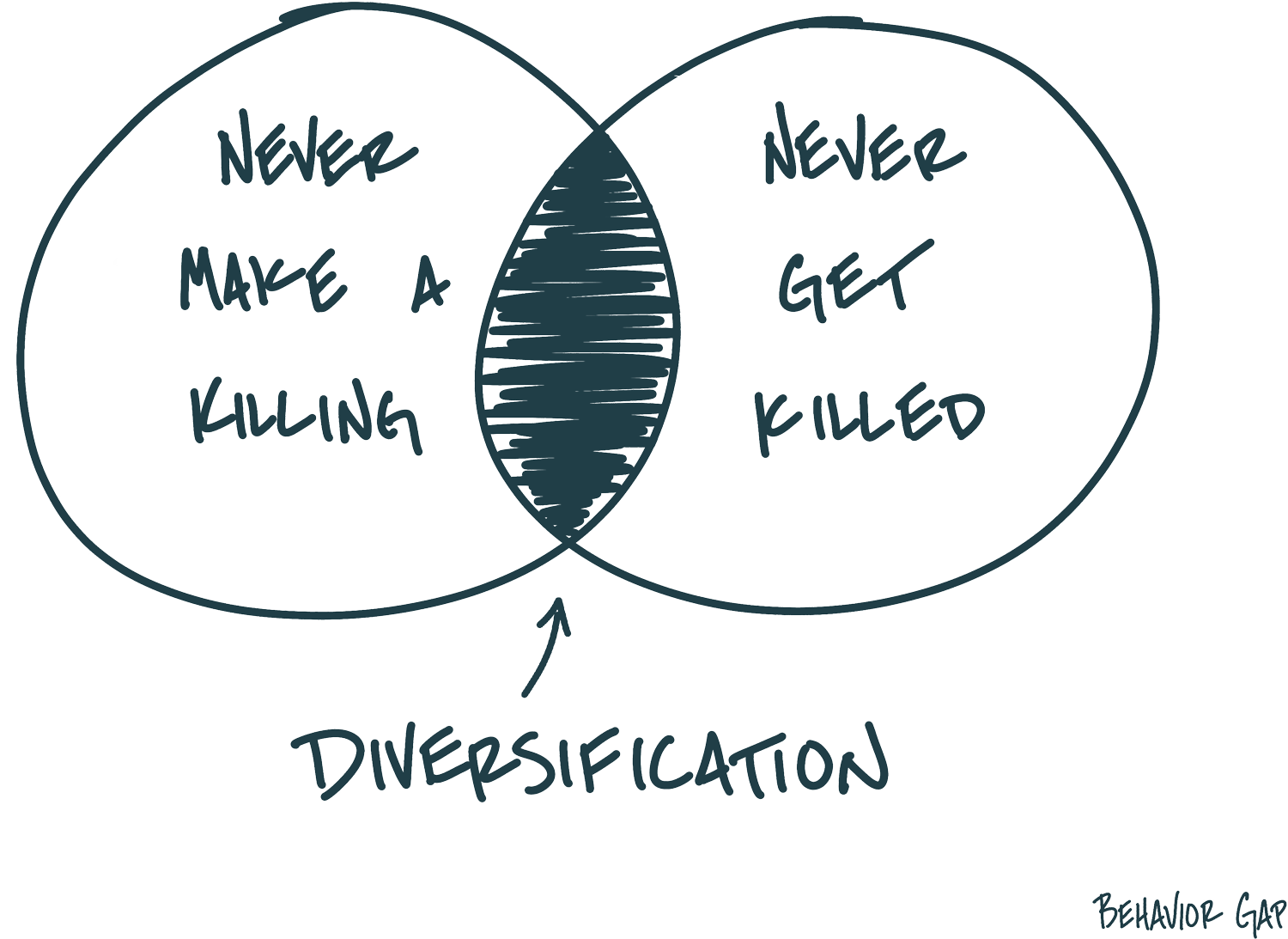

We’re not interested in “noise” from the media or speculators. Instead, our investment philosophy is based on rigorous academic research and evidence built up over long periods – all grounded in a worldview of continuous questioning, and pursuit of a wider investment horizon rather than looking for shortcuts.

Long-term investing means weathering storms in markets, and a clear investment philosophy gives strong foundations and a focused vision for doing so.

Production

Production