31 Jan 2025

Who we can help: Critical Illness and Disaster Prevention

Most of us have heard the saying prevention is better than cure. In financial planning, there are hard conversations that can be made easier by preventative measures.

This month we’re exploring a disaster preparedness conversation. If you or someone you care about hasn’t had a hard conversation like the one we describe below, or can’t confidently say you’re sorted on these issues, please get in touch for a free initial chat about your circumstances and potential planning needs:

https://calendly.com/duncan-bw-hoebridgewealth/30min

Critical Illness – “we had to move home because Mum fell seriously ill”

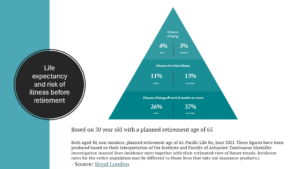

An acute or prolonged illness can put tremendous stress and pressure on a family – whether it happens to a full-time worker, or a stay-at-home parent who does all of the other things that make the household function. Recent data suggests the chances of someone being unable to work for at least 2 months, suffering a critical illness, or dying, between the age of 30 and 65, are 26% for men, and 37% for women.

While many people have at least some life-insurance, the right level of critical illness cover (which can pay a lump sum in event of some cancers, or heart failure, as well as other prevalent diseases) as well as income protection cover (to fund extended periods of time when unable to work due to ill health), may be vital to allowing a family to continue to pay their mortgage, or meet their daily expenses during this period of unexpected difficulty.

It is worth remembering that statutory sick pay is £116.75 per week, but is only paid for up to 28 weeks. Ensuring that you have the right amount of cash savings held in reserve is one of the building blocks of a sound financial plan, but even then, living off savings has a definite time-limit that can easily be reached in the case of prolonged illness or quickly used up when facing a critical illness.

The perception can be that this cover is expensive, and it is typically more costly than life cover (because you’re statistically more likely to need it), but the peace of mind it can bring a family may be well worth the monthly cost.

An illustration:

As a very generalised example**, we could consider Mr and Mrs Cornflakes, both age 40, non-smokers, he’s an accountant earning £100k, she’s a solicitor earning £70k.

Income protection (paid monthly after 26 weeks) with cover lasting for 17 years and premiums guaranteed (they don’t increase) – for income cover of £4,000 per month.

Joint Life and critical illness (first death / event) – in the event of death or earlier critical illness, cover lasting 17 years, premiums guaranteed (they don’t increase) – covering a £100,000 lump sum.

Joint Life and critical illness (first death / event) – in the event of death or earlier critical illness, cover lasting 17 years, premiums guaranteed (they don’t increase) – covering a £100,000 lump sum.

The cost? Around £108 – £115 per month with a variety of well-known insurers.

While income protection may end up not ever needing to be claimed, it is not uncommon where claims arise for the protection to be paid out over several years, or in severe cases, even across decades of prolonged debilitating circumstances.

How much is peace of mind worth? And not having your chances of a happy life marred by one unpredicted (but not unprecedented) illness or mishap?

One other note is that the premiums payable are a cost that a grandparent could cover out of excess disposable income of their own, if they so wished. Not an exciting present after Christmas, but it could save a great deal of family trauma if the unthinkable happened.

What’s your safety net in case of disaster?

Want to discuss this further? Book a free initial chat together.

https://calendly.com/duncan-bw-hoebridgewealth/30min

Note: Life Assurance and Income Protection plans typically have no cash in value at any time and cover will cease at the end of term. If premiums stop, then cover will lapse.

Plans may have various definitions of a critical illness and not all plans cover the same range. The definitions vary between product providers and will be described within the policy documentation. Exclusions may apply.

Income Protection benefits may affect any claim to means tested state benefits. Not all illnesses are included, full details will be incorporated within the Policy Summary.

**Please note that the above are indicative figures only and actual quotations will depend on your specific circumstances. This is not intended as specific advice, for which you should consult a qualified professional.

Production

Production