30 Dec 2024

Thinking: What is money?

What is money? What value does it have to us?

This is not just a personal question, but also a philosophical question many of us face in our modern world.

Among other things money acts as:

- a store of value – meaning that we can overcome bartering and obtain things we need or want

- a scoring system or marker of status – modern capitalism tends to associate success with money accumulation

- a proxy for other things we can’t easily put a price on (more on this below)

I think some of my friends were perhaps a little bit surprised when I became a financial planner – because I’m not necessarily a money-motivated person. I had opportunities earlier in my career to experience work in investment banking, big 4 audit, and management consultancy, but I suppose I was greedy in a different way: I wanted fulfilment and meaningful personal relationships, not only income. And my experience has been that a great many people who are really successful are passionate about what they do, and their financial success is only a part of their overall achievement.

Money is complicated because it can mean such different things for different people. Our personal histories shape our views, and sometimes there can be significant fear or negativity associated with money or discussing it with others. It can be a pressure point in the relationships of couples. We often form habits or emotional associations with personal finance quite early in life – and it can take deep self-reflection to figure out what limitations we are placing on ourselves.

Money is complicated because it can mean such different things for different people. Our personal histories shape our views, and sometimes there can be significant fear or negativity associated with money or discussing it with others. It can be a pressure point in the relationships of couples. We often form habits or emotional associations with personal finance quite early in life – and it can take deep self-reflection to figure out what limitations we are placing on ourselves.

Sometimes older generations are nervous that their children or grandchildren may use an inheritance in ways that they would not approve of. It is said that power corrupts, and there’s often a fear that money also corrupts or can rob people of motivation in life if it comes too easily.

But another way to frame thoughts about money and family discussions around this potentially taboo subject, is that character formation is partly about wealth and power, but not the whole part. And money therefore simply amplifies our value systems and personal goals, as well as supporting us in achieving those.

Morgan Housel writes insightfully in “The Psychology of Money” (one of my favourite books relating to personal finance and investing) about two key points worth highlighting here:

First, that money’s greatest intrinsic value is the ability to give you control over your time. To free yourself of tasks or activities that aren’t your best talents or things you know you don’t enjoy. Housel elaborates that control over your time is a dependable predictor of feelings of well-being, and yet because more of us are constantly working in our heads (in a way that decades ago maybe only those with senior management responsibilities ever did), arguably for much of the work-force, control over our time has actually diminished. So despite increasing per capita wealth and earnings, we shouldn’t be surprised that people don’t necessarily feel much happier.

Second, that wealth is what you don’t see. It’s not the obvious expenditure, but what people aren’t spending, and can therefore draw on when needed, that makes a person or a family wealthy. Living beneath your means gives you choices: the chap with the 14 year old car might not be worse off than the person with the brand new top-of-the-line vehicle – indeed, one of them might be leveraged to the hilt while the other is planning to pick and choose what they do and how they do it, from their early 50s.

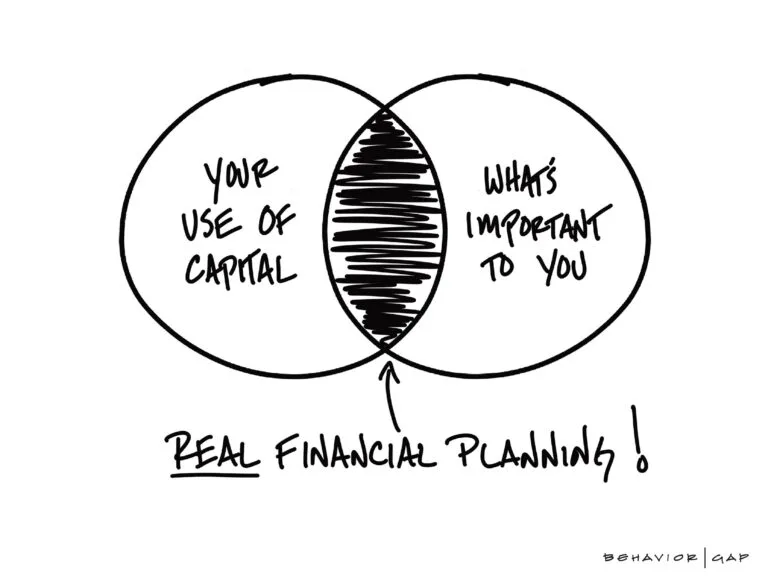

If money is therefore also about time, and achieving purpose, and gaining life experience, then if you’re planning carefully how you allocate and use your money, you’re helping yourself, and possibly also others, with those things too.

If you’re serious about living your best life, you seek guidance and expertise along the way. Whether that’s a personal trainer for fitness, the local pro to improve your golf or tennis technique, enlisting professional support to help you steer your career or achieve leadership potential, seeing a therapist to guide you or your family through conflict or unresolved feelings, or delegating to specialists when it comes to complexities like accounting, or writing your will.

The same guidance and expertise should be applied to your personal finances.

If you would like to discuss any of this further – please book a free initial chat together

Note: The content of this article is for information purposes only and does not constitute advice. It is not an offer to purchase or sell any particular asset and it does not contain all the information which an investor may require in order to make an investment decision. Please seek professional advice before entering into any financial arrangement.

Article updated Sep 2025

Production

Production