30 Sep 2025

Investment: Should I change my investment strategy approaching retirement?

“Sequencing Risk” is one of the great euphemisms of retirement planning. It refers to the risk that just as you get ready to sail off happily into your retirement, disaster strikes: the value of your investments is severely reduced, and all of your retirement calculations are thrown completely. What was once a comfortable, sustainable and affordable retirement, is suddenly not at all sure.

There are entire sections of the financial services industry devoted to assuaging fears over this happening. Many large fund managers run what are called ‘lifestyle’ funds, which gradually and automatically reduce the overall risk exposure of your portfolio each year as you approach retirement. That way, the total amount by which the value of your investment is likely to fall is reduced. This may be well-suited to those who are considering purchasing an annuity on retirement – once the traditional route for a majority of retirees. However, as we’ve noted, annuities aren’t necessarily as helpful as they once were.

For others, the problem with ‘lifestyling’ is that reducing risk in your portfolio also reduces the overall returns on your investment. Morgan Housel, in one of my favourite personal finance books, “The Psychology of Money”, calls risk the entry price you pay for the chance to obtain better investment rewards. So if you’re investing for a long retirement, reducing your investment risk significantly at the outset may reduce the volatility of your investment value, but it also increases the risk that your investments will fall behind inflation over time.

Another common approach to ‘retirement’ specialist portfolios is to bundle in ‘alternatives’ such as commodities, or assets that purport to behave very differently in times of financial stress. There are even ‘absolute return’ funds that are meant to always produce a decent return on the investment, regardless of which way the market is going. In reality, it is nearly impossible to have both risk which produces investment rewards and also certainty (a less bumpy ride, for example). Suffice to say no-one has yet found the holy grail of an investment that always does well no matter what is happening in the real world, and any claims otherwise should be taken with a shovel of salt.

Our preferred approach at Hoe Bridge is not to consider fangled portfolios, but rather to plan out your capital into different buckets – aligned with a short, medium and long-term time frame. You keep your short-term funds very low-risk – e.g. in a cash reserve, and then you take gradually more investment risk with your medium and long-term investments – based around your overall investment risk attitude and ability to withstand volatility in your total investment value.

The idea is that in bad times, you’ll live off your cash, and in good times, you’ll live off your investments and also potentially replenish the cash from your more risky long-term investments. Getting this right when the sequence isn’t a good one (namely a downturn right as you retire), means there are a few key factors to consider in your planning:

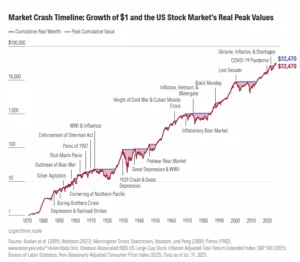

- How long will a downturn (typically a fall of 20% or more) take to recover?

- At what point do you begin to adjust / call on other non-cash investments – i.e. what is ‘medium-term’ in your plan?

- Do you have any flexibility in your spending plans? Might you consider for example a cap and collar in your annual income requirements – so that you don’t take too much out of your portfolio in good market years, nor too little in bad years?

The below chart from Morningstar shows recovery times for various US stock market downturns (an interactive version of this chart is available – see link below (1).

Even in good times, it is easy to be batted in different directions by the financial media and advertising of financial products as well as the hazard warnings of the financial services industry. Because, unless you’re fortunate enough to have a final salary pension that meets all of your needs, you’re now responsible for the bulk of your retirement income and investment decisions. It can be a great support to work together with a skilled financial planner to map out the various scenarios and plan ahead. Times of stress can also be weathered more easily with a trusted adviser at your side to help you stick to the plan and make sensible adjustments where necessary.

Finally, it’s worth remembering that good financial planning doesn’t just consider the downside – sometimes the best retirement adjustments are when you are being urged to live a bit more, and spend some more on enjoying your life, secure in the knowledge that you’ve planned ahead for the future too!

If you want to discuss your retirement planning, pensions and investments or wider financial planning – book a free initial chat with me

https://calendly.com/duncan-bw-hoebridgewealth/30min

NOTE: A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The value of your investment can go down as well as up. Past performance is not a reliable indicator of future results. None of the above is financial or investment advice and you should speak to me or someone else professionally qualified to give you advice specifically tailored to your circumstances.

COMMENT

1 – Morningstar chart – here

Production

Production