30 Nov 2025

Investment: Are there ways to add value to index-tracker investing?

Although investing in index-tracker funds is very common these days, we have outlined elsewhere that this isn’t necessarily an optimal investment strategy, and that there may be ways to generate even better long-term returns for investors.

One of these is factor-based investing – which is a strategy that involves selecting investments based on attributes that are associated with higher investment returns (see Footnote 1 below). Factor investing is designed to increase diversification, generate above-market returns, and manage risk. It does not achieve this in all market conditions, and as with any strategy, there are times when it is likely to underperform an index-tracker investment which mechanically follows the entire market or a specific index.

Factor-based investing is most famously associated with two Nobel Prize winning economists, Eugene Fama and Kenneth French, whose ground-breaking research indicated that over 90% of diversified portfolio returns could be explained by three ‘factors’ which are associated with premiums in investment returns (Footnote 2).

Other researchers have explored further factors, but these are not always easy to isolate as an investor, and can carry additional costs to implement which may erode the marginal added investment returns.

Among the various style factors identified are:

- Size

- Value

- Profitability

- Momentum

- Volatility

- Size refers to the historically observed trend that portfolios consisting of smaller sized companies tend to experience greater returns than portfolios with just larger sized companies – which makes sense somewhat intuitively as a small company has greater growth potential than one which is already very large (remember also that any company publicly listed on a stock exchange is already fairly large – so we’re referring to a ‘smaller’ public company).

- Value aims to capture additional returns by identifying stocks that are trading at low prices relative to their fundamental value – this is commonly tracked by looking at share price comparisons with the accounting or book value, or the earnings, dividends or free cash flow of the company.

- Profitability refers to the differences between the returns of firms with strong or weak operating profitability – as historical analysis has tended to show that companies which have never consistently been profitable are more likely to struggle or provide poorer investment returns.

- Momentum refers to the fact that stocks that have outperformed in the past tend to exhibit strong returns going forward. This factor has however been quite difficult to execute in a cost-effective way in the real world, as it generally involves buying shares in a company whose share price has already risen substantially, and selling shares in companies whose share price has already fallen.

- Volatility refers to the extent of the rises and falls in a company’s share price. Research suggests that companies with lower volatility earn greater risk-adjusted returns than highly volatile assets. This does not necessarily mean however that the overall investment returns from adjusting for this factor will be higher, and volatility-focused investing can tend to reduce the overall investment risk profile, and with it, the total investment returns earned. This strategy may have a place for those with a lower investment risk appetite as one of their main motivations.

One of the difficulties with the financial theory of investing in factors capable of generating additional returns, is how to execute this in practice. The approach taken by Dimensional Fund Advisers (DFA), now copied by many others, with some mixed success, has been to start with a proportional replication of the entire market based on market capitalisation of major markets and publicly listed companies, and then to ‘tilt’ their portfolio in a rules-based way toward the factors of Size, Value and Profitability. Dimensional also do incorporate an element of Momentum factor in how they execute their investments – which is colloquially referred to as avoiding buying roses on valentines day (not buying shares when the price has momentarily spiked upward).

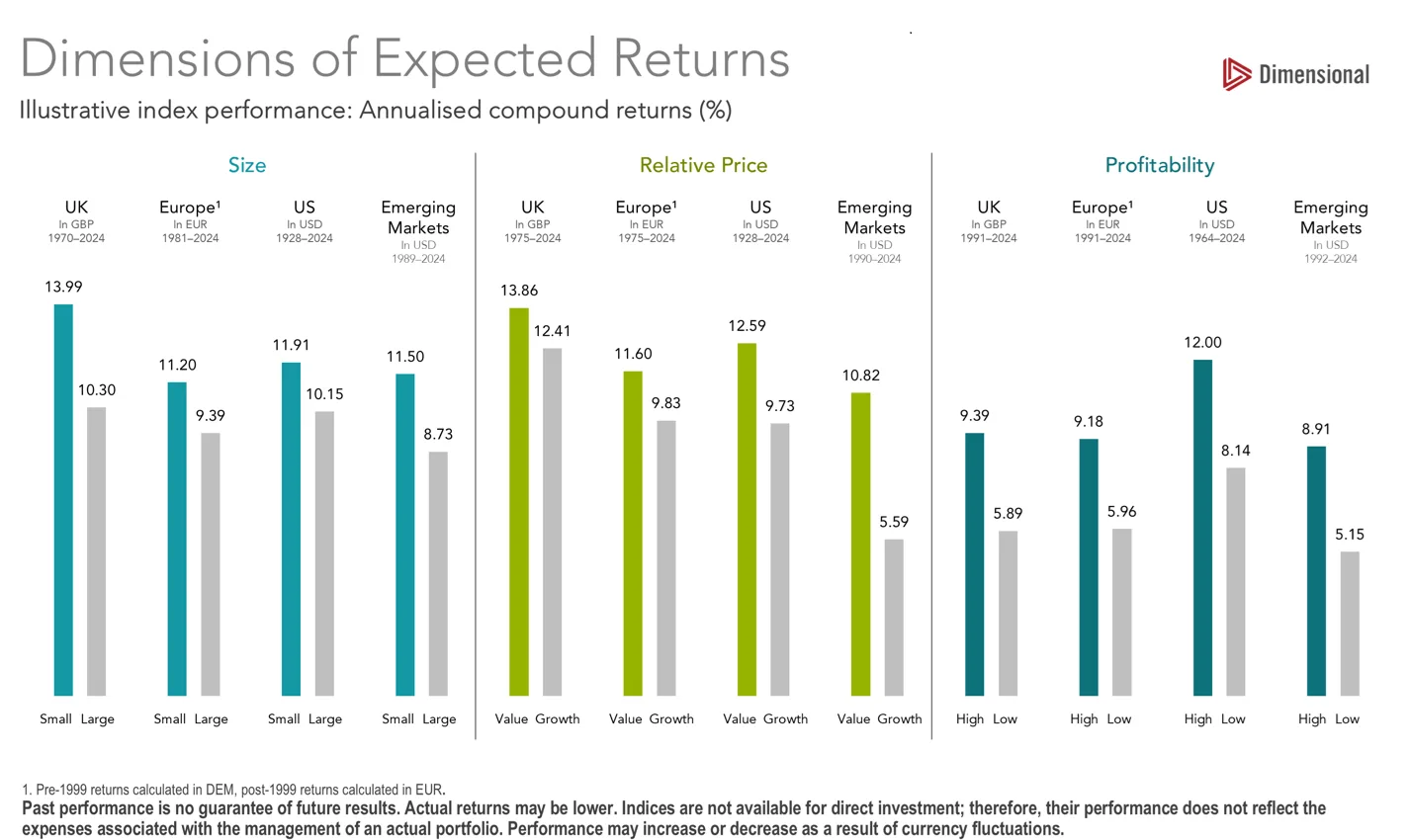

How well does this Factor-tilt actually work in practice? Research from Dimensional indicates that over the longer-term investment horizon that is relevant for most investors in markets, the factors of Size, Value (also referred to as ‘Relative Price’) and Profitability have historically delivered higher investment returns compared with their opposites. As you can see from the chart below, this premium persists across different regions of the world and various different time periods (some of which are dictated by the limits of available data for historic comparability).

Our Hoe Bridge Wealth investment philosophy has embraced this research and includes portfolio tilts which seek to capture the risk premiums associated with Size, Value and Profitability described in this article, which are likely over time to provide a more rewarding investor experience.

Click on the link below to read more about our investment philosophy (Footnote 3)

What is your investment approach and how do you ensure that you’re sticking to it?

If you want to discuss your investments, or wider financial and retirement planning – book a free initial chat with me:

https://calendly.com/duncan-bw-hoebridgewealth/30min

NOTE: The value of your investment can go down as well as up. Past performance is not a reliable indicator of future results. None of the above is financial or investment advice and you should speak to me or someone else professionally qualified to give you advice specifically tailored to your circumstances.

Footnotes

1 – Factor Investing definition

Production

Production